Accounts payable in accounting and financial statements (0)

Accounts payable are debts that arise from purchases. In other words, when goods or services are purchased but not paid for immediately, they are recorded under this account on the liabilities side of the balance sheet. When the buyer records an account payable, it also means that the seller records an account receivable. It’s important to remember that this liability must always be based on an invoice received from an external party – no other types of debts should be recorded under this account.

How does a purchase go into accounts payable?

A purchase is recorded in accounts payable when it isn’t paid at the time of purchase but is instead invoiced. This is very common – for example, with office rent or telephone bills. In accounting terms, purchases are recorded on the debit side, while accounts payable increase on the credit side.

EXAMPLE

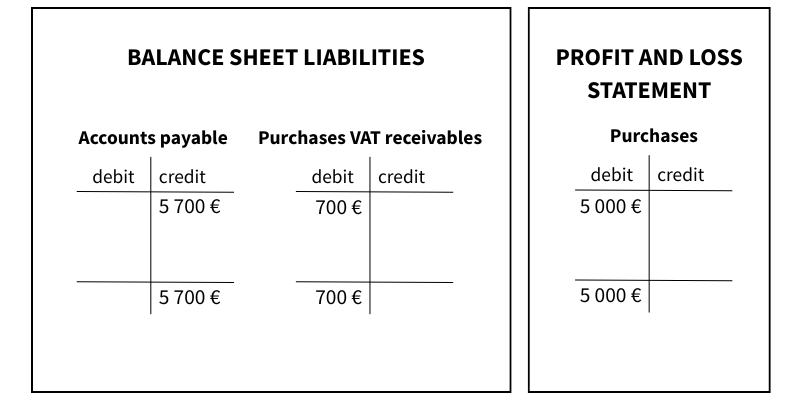

A company purchases products for sale worth €5,700 (incl. 14% VAT) on an invoice.

Invoice entry

-

- DEBIT:

- (4000) Purchases – Net purchase amount

- (1845) VAT receivables – VAT portion

- CREDIT:

- (2870) Accounts payable – VAT-inclusive amount

- DEBIT:

How is a purchase removed from accounts payable?

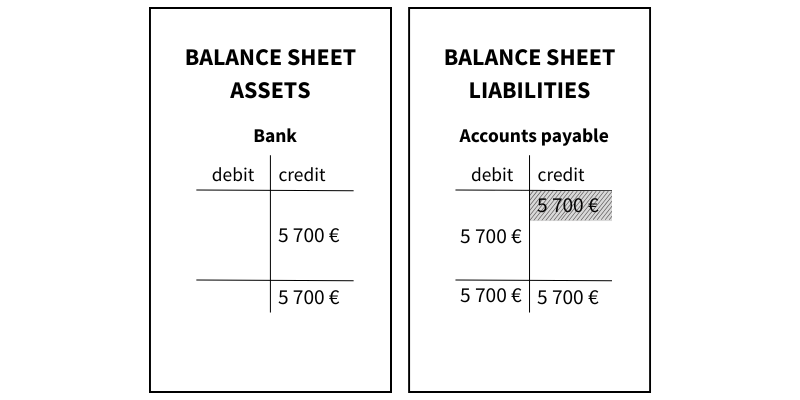

A purchase invoice is removed from the books simply by paying the invoice.

EXAMPLE

A company pays a purchase invoice from its bank account

Payment entry

-

- DEBIT:

- (2870) Accounts payable – VAT-inclusive amount

- CREDIT:

- (1910) Bank Account – VAT-inclusive amount

- DEBIT:

Once both sides of the entry (debit and credit) are equal, the liability cancels out. In the other words, the debt related to this invoice has been settled.

In the financial statements

Businesses that keep their accounts on a cash basis must adjust them to an accrual basis for the financial statements—this is when accounts payable definitely come into play. For companies that already use accrual-based accounting, purchase-related liabilities are recorded continuously throughout the year.

A key point in financial reporting is that a liability arises when a product or service has been delivered. For example, if the financial year ends on December 31st and goods are received on that date, but the invoice arrives in January, the expense must still be allocated to December.

It’s also important to understand the difference between accounts payable and accrued liabilities. Accounts payable should never include estimated liabilities—only debts for which an actual invoice has been received from an external party. Estimated liabilities include, for example, taxes, interest, and holiday pay, which in the financial statements belong under accrued liabilities.

In short: Accounts payable are simply unpaid invoices. It’s a good idea to keep track of them monthly to know how many purchases remain unpaid at the end of each month. If you use an electronic purchase ledger, paying invoices and keeping track of due dates becomes much easier!

Try right away!

A more advanced and easy accounting software SimplBooks with over 10,000 active users - register an account and you can try 30 days free of charge and risk-free (no financial obligations shall arise). Or try our demo version!

Leave a Reply