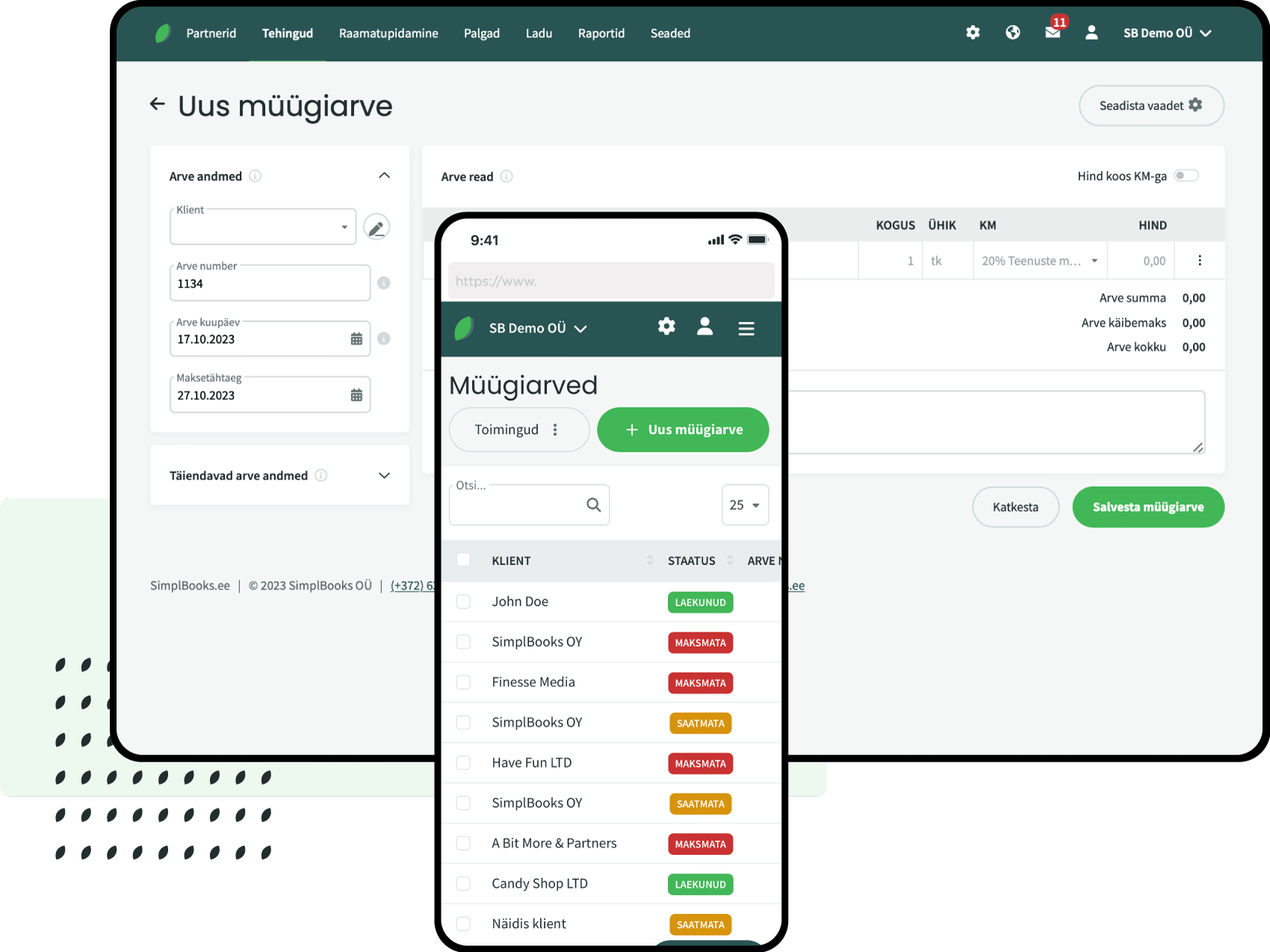

Salaries

The salary module in SimplBooks is closely integrated with the rest of the software. This means that, when calculating salaries, the financial entries related to them are directly entered in the accounts and immediately reflected in reports like the balance sheet and income statement. In addition, SimplBooks is able to automatically calculate holiday and sick pay according to preset rules. After calculating salaries, they can be marked paid either manually or via bank import, which is also immediately reflected in the accounts. As the final step, the system automatically prepares a TSD report based on salaries paid, which can be exported in XML format suitable for e-MTA.

- register of employees, salaries and payments

- calendar for holidays and sick leave

- calculation of salaries individually or all at once

- preparation and emailing of payslips (PDF)

- TSD reports that can be exported in a format suitable for the Estonian Tax and Customs Board

Holiday and sick leave calendar

In addition to the employee register, SimplBooks has a comprehensive calendar of employee-related events. The calendar can be used to mark things like holidays, sick leave or even notes about specific dates and employees. Calendar entries like holidays and sick leave are automatically taken into account in the calculation of salaries for the current period and are reflected in the salary calculated.

Calculating the salary of multiple employees

Every company and its employees are unique, but if all or most of the company’s employees work under the same conditions and, for example, for a fixed salary, this function is for you. In addition to calculating individual salaries, SimplBooks allows you to calculate the salary of all or a selection of employees at the same time. When calculating salaries at once, you will still see a summary of important information, but you will be spared of routine clicks.

Preparation of payslips

The SimplBooks system automatically prepares a payslip for each salary. Payslips can either be downloaded as PDF files or sent directly to employees. The payslip contains an overview of the salary calculated and the taxes withheld.

TSD report

Hiring employees and paying salaries comes with an obligation for companies to declare and pay withholding taxes on the salaries. We have tried to make this as easy as possible in SimplBooks. For example, based on salary payments, the system prepares the necessary preview of the income and social tax declaration, which can be exported in the XML format suitable for the Estonian Tax and Customs Board.

Pension Centre interface

One part of salary calculation is the calculation of funded pension according to if and when the employee has submitted an application to the Pension Centre. This is checked automatically in SimplBooks and the relevant information is displayed to you in the salary calculation view.

Holiday days report

Do you want to know how many unused days of holiday you or your employees have? This information is easily accessible in the holidays report. You can also see holiday balance statements for the past, present and future. The holidays report takes into account the start date of the employment relationship and events in the employee calendar.

Marit Meierau, raamatupidaja (Randemar OÜ)

“SimplBooks on minu jaoks väga loogiline programm, seda oli kerge selgeks õppida ja erinevaid toiminguid on mugav teha.

Kasutan suurt osa funktsionaalsusest – müük, ost, töötasud, kuluaruanded, põhivara, raamatupidamisaruanded. Kõiki andmeid saab filtreerida, mis teeb kiireks info leidmise mis tahes välja järgi.

Väga mugav funktsioon on pangaliides – ei pea ise panga faili alla laadima, vaid kõik liigub automaatselt. Pangast tasutud arvete puhul seob juba kliendiga ära, jääb üle vaid kinnitada. Ka kuluaruanded on mugavalt koondatud ühte kohta. Ühendus Maksuametiga on väga käepärane tööriist, see säästab klikke ja aega, saab maksudeklaratsiooni ühe nupuvajutusega Maksuameti keskkonda edastada.”