Debit and credit – where money goes and where it comes from (0)

In the secret language of accounting, the terms debit and credit are used – and in an even more secret dialect, they are called per and an. If you ever want to casually chat with an accounting guru and sound knowledgeable, sprinkle these words here and there. You’ll make an even better impression if you use them in the right places!

Both sides of an accounting account

Every account in accounting has two sides. The debit side, on the left, shows where the money goes, and the credit side, on the right, shows where the money comes from. In double-entry bookkeeping, each transaction must be recorded as a debit in one or more accounts and as a credit in one or more accounts. The total amounts on both sides must always be equal.

Debit

In accounting, expenses are always recorded on the debit side — that is, where the money goes. This can include purchases, salaries, insurance, car expenses or anything else. Whenever money is spent on something, it should be recorded on the debit side.

|

EXAMPLE

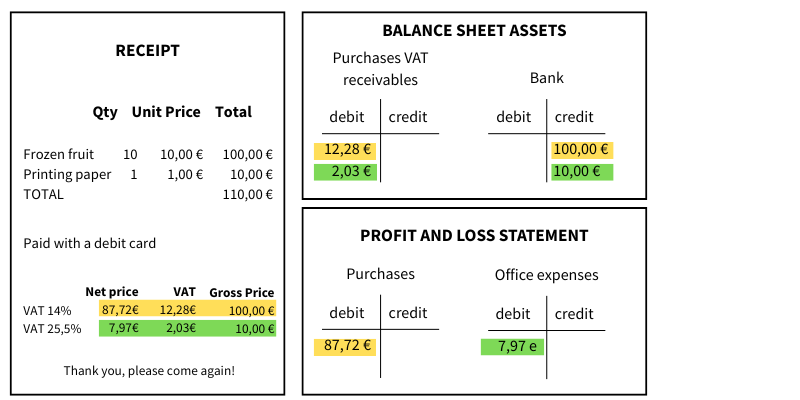

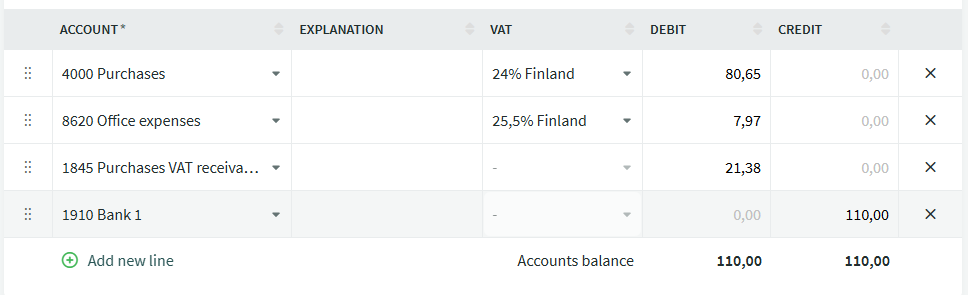

An entrepreneur buys frozen fruit wholesale for preparing drinks for sale, as well as printing paper. The frozen fruit costs €100 and the paper €10, including VAT. The entrepreneur pays for the purchases using the company’s bank card.

Receipt entry

|

Software makes it easier

Depending on the software, you may not need to record the VAT portion separately. For example, in SimplBooks, entries are made using the VAT-inclusive amount, and the system automatically calculates the VAT and posts it to the correct account. You just need to make sure to select the correct VAT rate for each transaction. The software then calculates the VAT and posts it to the correct account automatically.

Credit

The credit side shows where the money comes from. If you buy something, the purchase is recorded on the debit side, and credit shows how the purchase was paid. If you deposit money into the company’s bank account, it is recorded on the bank account’s debit side, and credit shows the source of the funds. Sales are always recorded on the credit side.

|

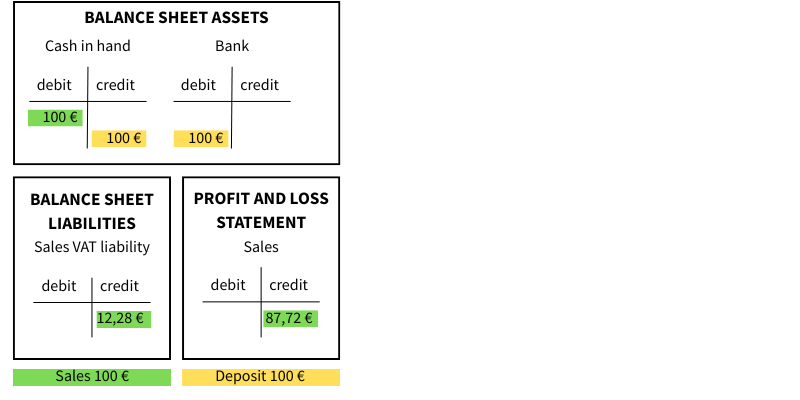

EXAMPLE

An entrepreneur sells drinks for €100 in cash (the money comes from the sale and goes into the cash register).

Sales entry

The entrepreneur deposits the cash into the company’s bank account (money comes from the cash register and goes into the bank account).

Cash deposit into a bank account entry

|

Debit and credit aren’t difficult if you don’t overthink them. When deciding which side to use, consider whether the account balance increases or decreases, and remember that sales increase on the credit side while the bank account increases on the debit side. And now, the secret of per and an can be revealed: per means debit, and an means credit. In spoken language, you might say: “Record the frozen fruit per purchases VAT 14% an bank account,” and the listener will instantly understand – or at least pretend to.

Try right away!

A more advanced and easy accounting software SimplBooks with over 10,000 active users - register an account and you can try 30 days free of charge and risk-free (no financial obligations shall arise). Or try our demo version!

Leave a Reply